BMCE Capital Gestion

With a strong expertise in managing funds, our team of experts will help you build the very best investment strategies across all asset classes.

Myriem BOUAZZAOUI , Chief Executive Officer

As a leading player in Morocco’s Asset Management industry, BMCE Capital Gestion provides institutional, corporates and individual investors with effective investment solutions.

Since 1995, BMCE Capital Gestion has built a reputation for high-quality investment solutions and organisation that meet the highest global standards. Our strategy is driven by innovation and the will to continuously outperform in every level of our business.

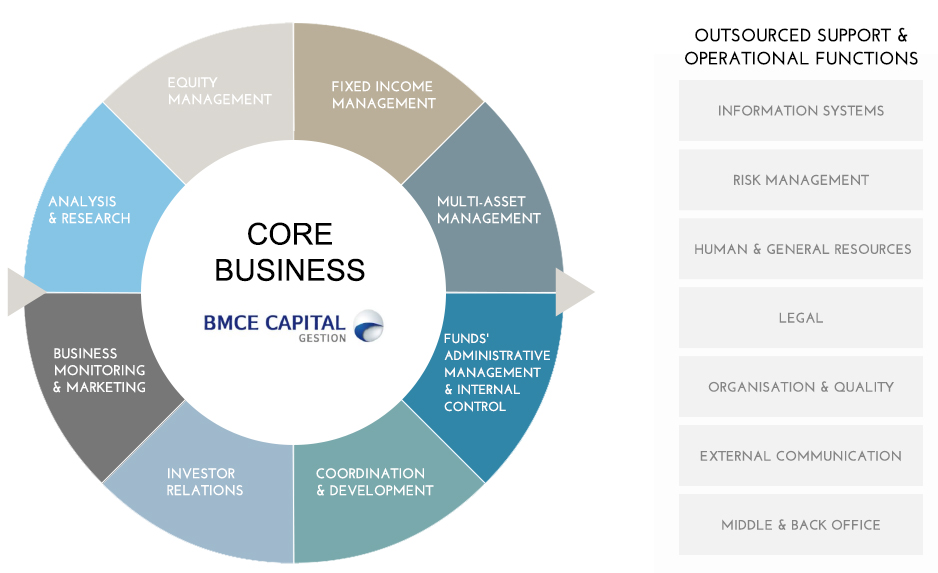

We benefit from the solid support of BANK OF AFRICA Group, one of the leading financial institutions in Morocco, as well as the expertise of support functions of its investment bank, BMCE CAPITAL. To serve your interests as best as we can, we focus all our efforts on our core business, the asset management.

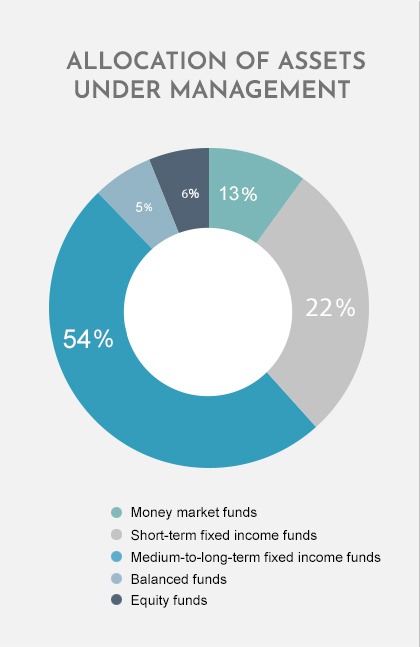

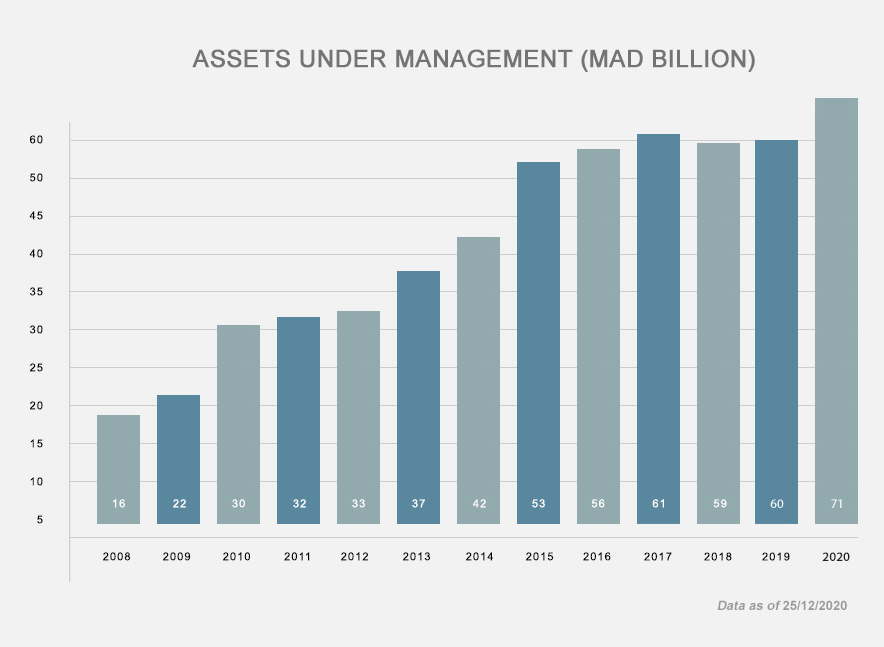

BMCE CAPITAL GESTION IN FIGURES

- Data as of 25/12/2020

VALUES & COMMITMENTS

Our mode of governance ensures that we operate with independent oversight and with full transparency towards our clients. Our team of experts is dedicated to guide you and advise you over the long term.We are strongly commited to risk control and continous innovation, resulting in high-performing investment solutions which are tailored to every need.

Our aim is to build a relationship of trust and to help you create value.

Meryem BOUAZZAOUI, Chief Executive Officer

-

-

DISTINCTIONS & AWARDS

TEAM & ORGANISATION

TEAM EXPERTISE

Our team is entirely focused on our core business, asset management. Whether it is market analysis, asset management, customer relationship management or control processes, we are dedicated to managing funds so as to meet all of your needs. The Risk and support functions (legal, IT systems, risk management, human resources, organisation and quality) are provided by BMCE Capital.

Our team is made up of expert asset managers and investment advisors specialised by investor profile (institutional investors, corporates and individual investors). They provide customised services on a continuous basis.

Customer relationship management at the core of our organisation

The Investor Relations Unit is the interface between BMCE Capital Gestion and you.

Our investment advisors are specialised in three different client segments: institutional investors, corporates and individual investors. They are in regular contact with you through meetings or telephone calls. Ongoing contact enables to monitor results and provides you the best possible guidance depending on your investment needs.

Customised solutions can be provided in respect of specific investment requests in conjunction with the investment management team, particularly regarding replies to consultations.

Investment advisors are responsible for monitoring the entire order process, from when an order is placed right through to conveying investment reports to clients.

Investor Relations’ main responsibility is to keep you informed and advise you.

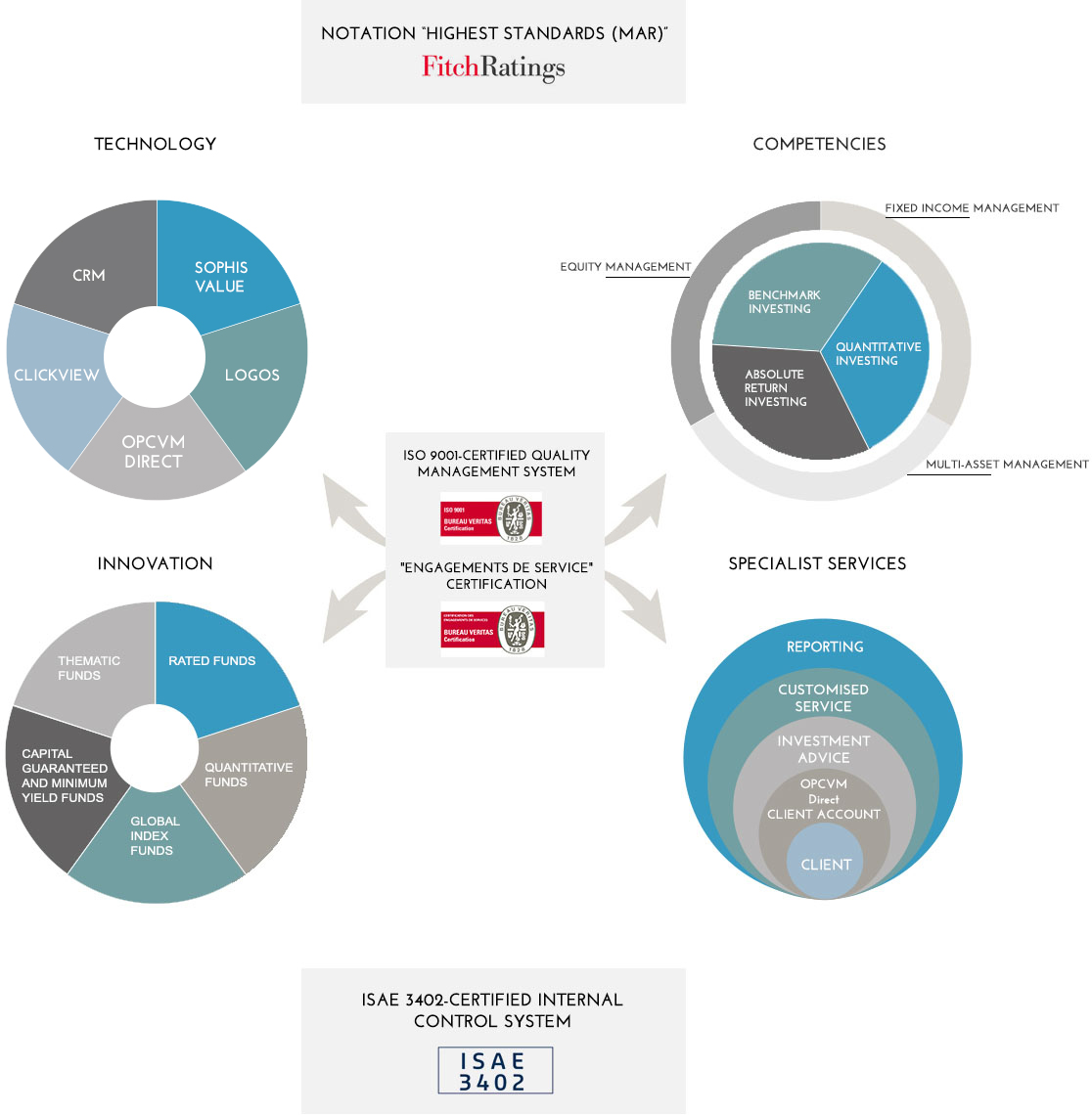

A SUCCESSFUL ORGANISATION

Our organisation and governance system allow us to take a highly disciplined approach to managing investments. Several committees covering investment, management, sales strategy, risk and innovation ensure that our actions are rigorously monitored.

Our cutting-edge IT systems enable us to manage assets and liabilities in line with the highest global standards and steer our business with precision :

-the SOPHIS VALUE solution : the leading software solution in the portfolio management and risk management industry

-CRM BMCE Capital Gestion : a specialist CRM tool

-BI BMCE Capital Gestion : the next-generation business intelligence application.

MILESTONES

Years

Years

- Fitch affirms BMCE Capital Gestion at 'Excellent (mar)'

- At the MENA Fund Manager Performance Awards 2018, FCP Capital Long Short won the best fund award in the "New Comer" category

- Fitch affirms BMCE Capital Gestion at 'Excellent (mar)'

- At the Lipper Fund Awards MENA 2018, the following funds won awards for their performance quality:

- FCP Capital Terme: Best Fund awards in the "Bond MAD" category

- FCP Capital Imtiyaz Liqudité : Best Fund award in the "Bond MAD Short Term" category

- FCP Capital Multi-Gestion: Best Fund award in the "Mixed Asset MAD Balanced" category

- At the MENA Fund Manager Performance Awards 2017, FCP Capital Combo won the best fund award in the "New Comer" category

- At the Lipper Fund Awards MENA 2017, the following funds won awards for their performance quality:

- FCP Capital Balance: Best Fund award in the "Mixed Asset MAD Balanced" category

- FCP Capital Terme: Best Fund award in the "Bond Morocco Dirham" category

- "Engagements de Service" and ISO 9001:2015 certifications obtained

- Launch of Morocco's first mutual fund with an investment strategy based on Long/Short strategies : FCP Capital Long/Short

- Fitch affirms BMCE Capital Gestion at 'Highest Standards (mar)'

- BMCE Capital Gestion celebrates its 20th anniversary with the launch of its institutional website and OPCVM Direct for client accounts

- At the Lipper Fund Awards MENA 2015, the following funds won awards for their performance quality:

- FCP Capital Multigestion: Best Fund award in the "Mixed Asset MAD Balanced" category

- FCP Capital Participations: Best Fund award in the "Equity Morocco Dirham" category

- FCP Capital Terme: Best Fund award in the "Bond Morocco Dirham" category

- FCP Capital Imtiyaz Liquidité: Best Fund certificate in the "Bond Morocco Dirham - Short Term" category

- 2 new thematic funds launched:

- Investment theme focusing on Africa: FCP Capital Afrique

- Investment theme focusing on Social Responsibility: FCP Capital ISR

- 2 new funds launched with an innovative management approach:

- Multi-assets and multi-zones balanced fund: FCP Capital Global Macro

- Defensive fixed income fund with a dynamic exposure to equities: Capital Combo

- ISO 9001:2008 certification obtained for Quality Management System covering all BMCE Capital Gestion’s processes

- FCP Capital Imtiyaz Liquidité wins the award for the "Best Fixed-income Fund in Morocco" by Zawya Fund Awards 2013

- BMCE Capital Gestion’s internal control processes obtains ISAE Type II certification for compliance

- Fitch Ratings affirms its rating at ‘Highest Standards (mar)’

- BMCE Capital Gestion’s internal control processes obtains ISAE Type I certification for compliance

- Standard & Poor's assigns the "FCP Capital Monétaire" money market fund an ‘Af’ global rating

- Fitch Ratings upgrades BMCE Capital Gestion's rating to ‘M2+ (mar)’ from ‘M2 (mar)’

- Launched of "Capital Obligations Banques", a Moroccan fixed-income fund, investing in bank sector debt securities

- Winning of the EMEA Finance award for the best asset management company in Morocco

- BMCE Capital Gestion acquires SOPHIS VALUE, a cutting-edge IT management solution

- Launch of the Morocco’s first-ever capital guaranteed fund which replicates the performance of Eurostoxx 50, a European equity index

- Launch of Capital Immobilier and Capital Maghreb, two thematic funds, as well as Capital Multigestion, a fund of fund

- Fitch Ratings assigns a ‘M2 (mar)’ rating to BMCE Capital Gestion

- Company changes its name from ‘MARFIN’ to ‘BMCE Capital Gestion’

- Fitch Ratings assigns ‘AA-‘

- Capital Obligations Plus launched, the first Moroccan fund to invest exclusively in corporate debt securities

- Launch of a range of risk-profiled funds (FCP Capital Imtiyaz Expansion, FCP Capital Imtiyaz Sécurité and FCP Capital Imtiyaz Croissance), Morocco’s first equity index fund (FCP Capital Indice) and an industrial thematic equity fund (FCP Capital Participations)

- Launch of Morocco’s first mutual fund, Maroc Valeurs